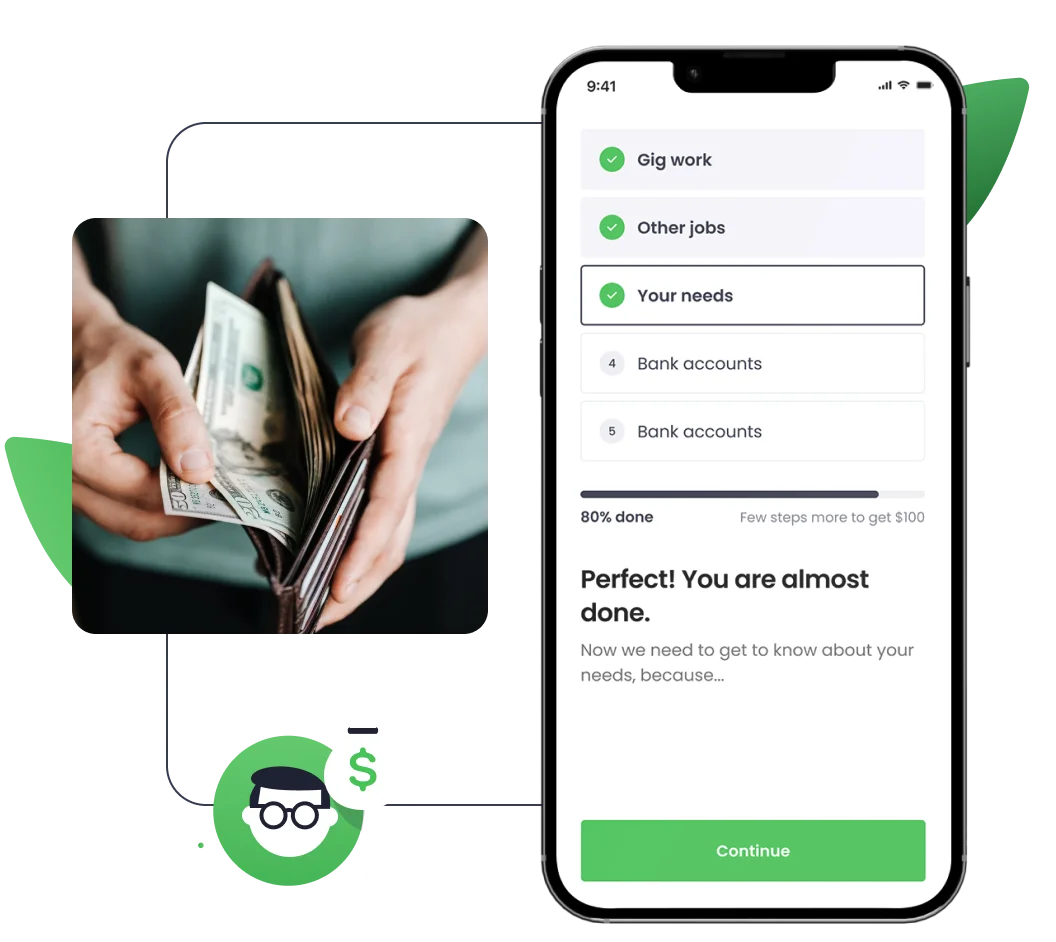

Installment Loans For Gig Workers

Loans that you can repay over a longer period of time (6-12 months). Borrow $2,500– $5,000.

Learn More

GigsCheck is the money plan for Gig Workers, Uber & Lyft Drivers, Self-Employed Workers,

Freelancers,

1099 Workers, & you.

Learn More

Applying won't affect your credit score

Installment Loans For Gig Workers Some FAQ's

Can gig workers with bad credit apply for installment loans?

Yes, it is possible to get installment loans with bad credit. Some lenders offer installment loans to gig workers, freelancers, and 1099 contractors with bad credit profiles. Such loans come with higher interest rates.

When would you use an installment loan?

Gig workers apply for installment loans for the following:

- To pay back large debts in small and manageable repayments.

- To finance large purchases.

- To make a significant home renovation.

- To pay for emergency travel expenses.

- To cover sizeable medical treatment bills.

- To consolidate your debts.

- To upgrade current gig job or business.

Can I repay my installment loan early?

Yes, you can repay your installment loan anytime at no extra cost and save interest.